Homeowner Shopping Attitudes Report 2025

Key Findings at a Glance

This report synthesizes insights from 422 verified homeowners who shopped for heating and cooling systems and other home services in 2025.

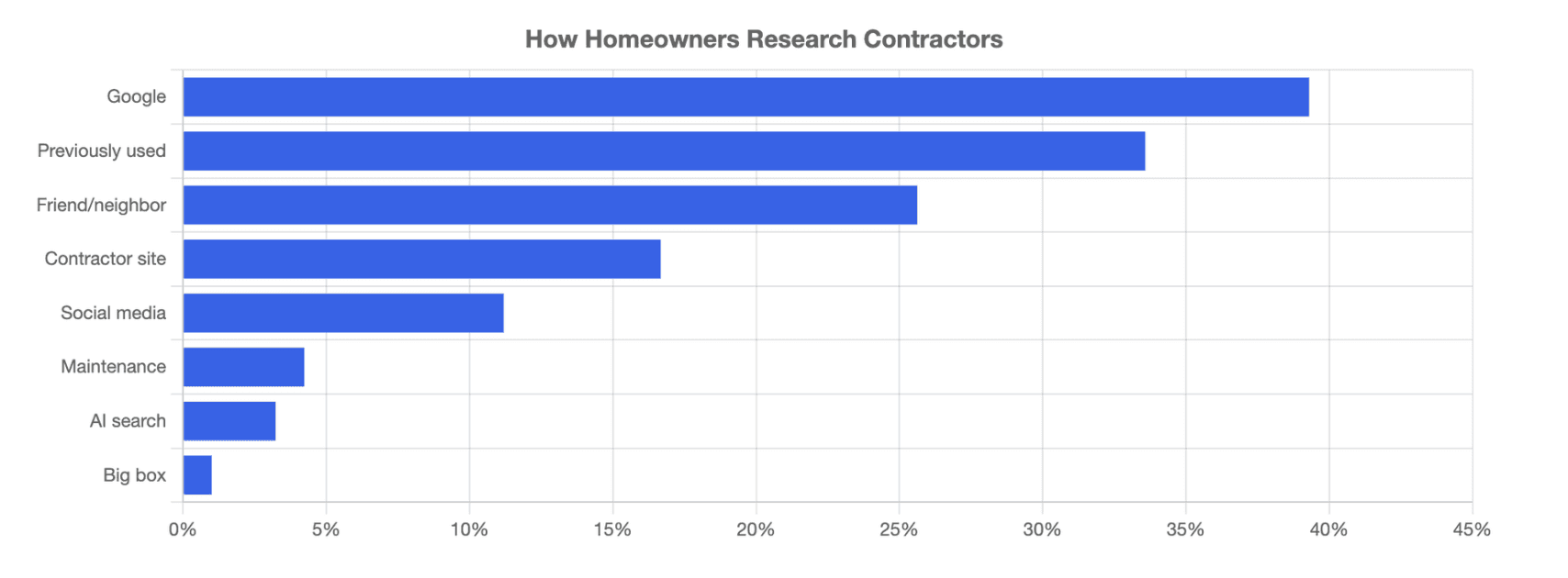

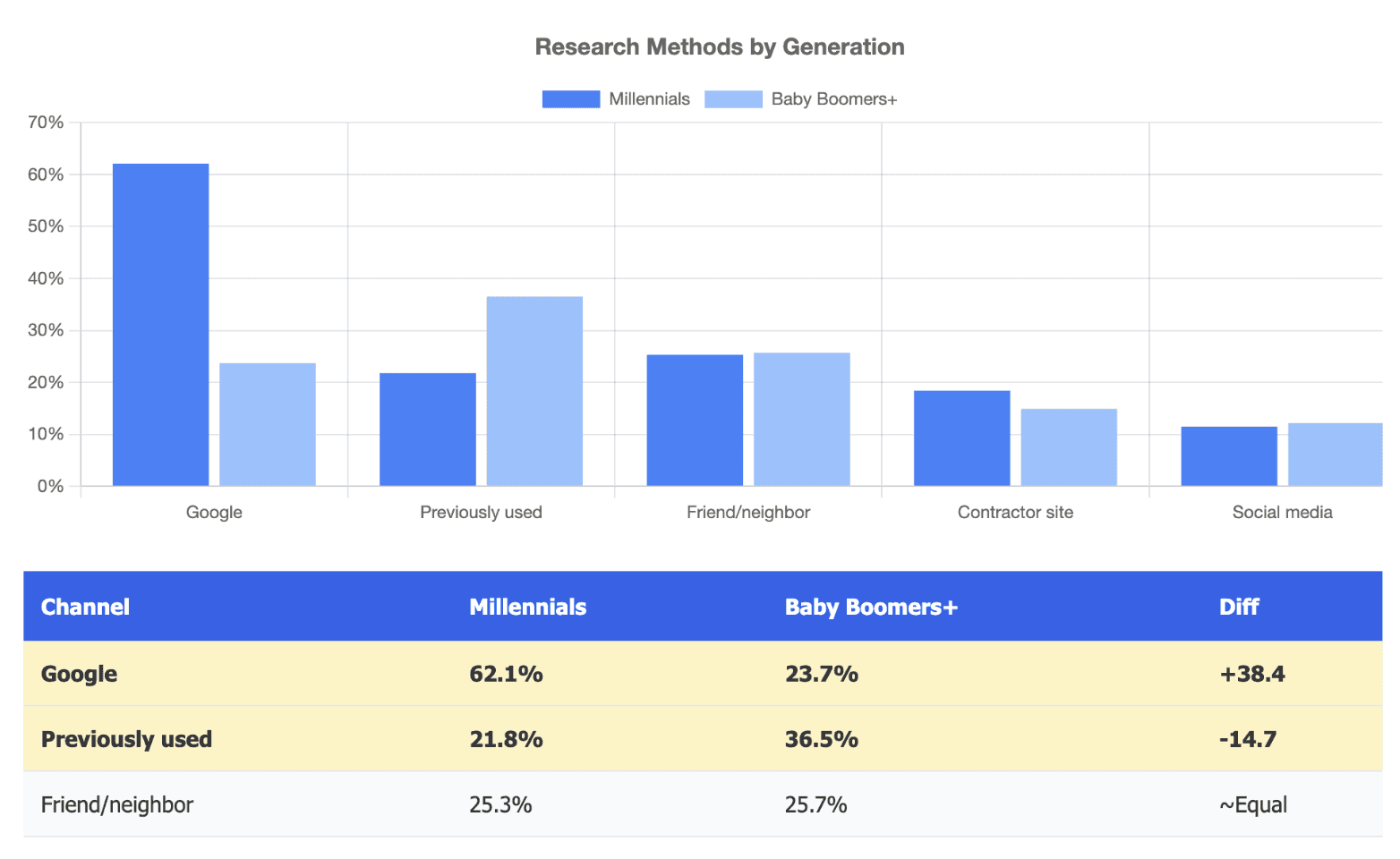

Google Leads, But Generations Diverge | 39% of homeowners start with Google. Baby Boomers prefer contractors they've previously used (36%), while Millennials are digital-first with 62% using Google. AI search tools like ChatGPT account for only ~3%. |

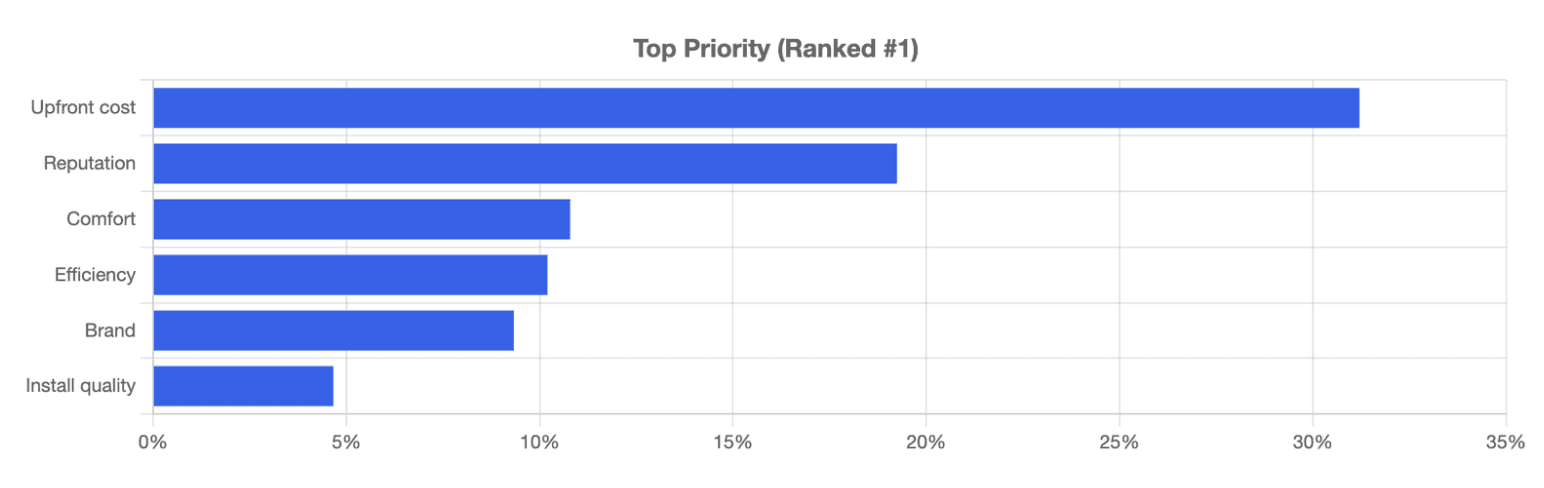

Price Matters, But 69% Prioritize Other Factors | While 31% rank upfront cost #1, 69% prioritize contractor reputation, system comfort, energy efficiency, and service quality. |

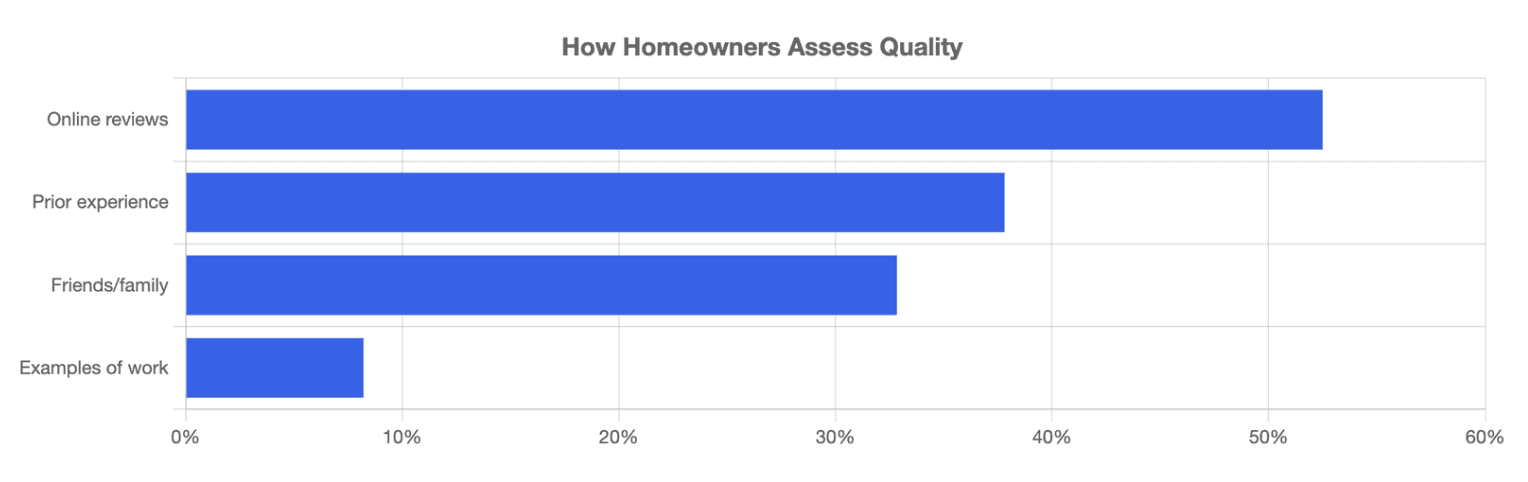

Online Reviews Are the Primary Quality Signal | 52% assess contractor quality via online reviews. Prior experience (38%) and friend recommendations (33%) round out the top three. |

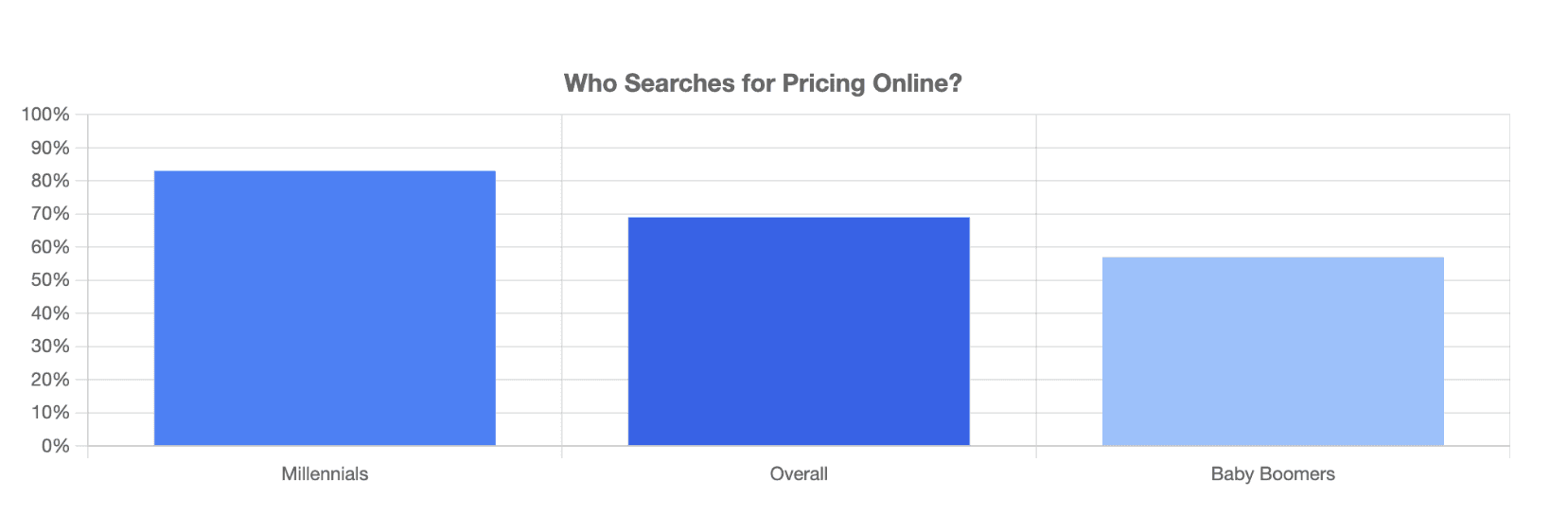

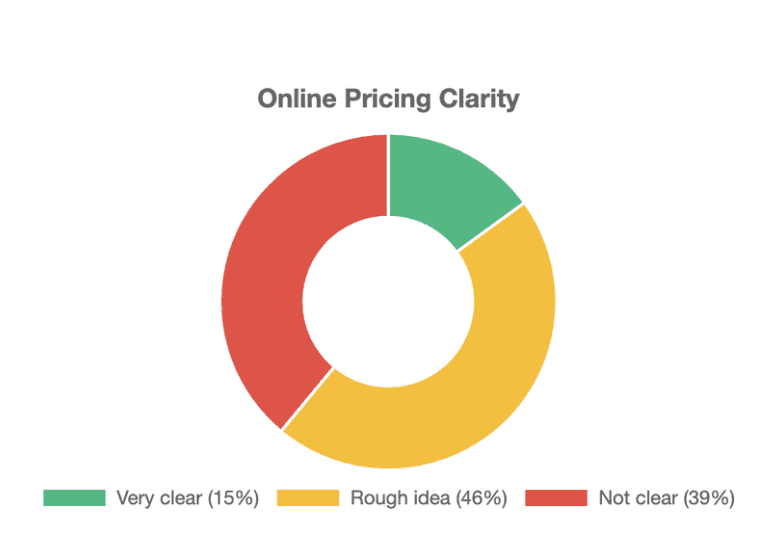

Online Shopping Fails Most Homeowners | 69% search for pricing online, but only 15% find it clear enough to estimate costs. |

2 - 3 Contractors Contacted When Shopping | Homeowners contact 2.1 contractors average (2.3 for Millennials). |

Relationships Drive Recommendations | 59.2% of homeowners rely on trusted connections when choosing contractors, either hiring someone they've worked with before (33.6%) or selecting based on a personal recommendation (25.6%). |

Survey Methodology

Research Overview

This survey was conducted in Fall 2025 with 422 verified homeowners who actively shopped for heating and cooling systems in calendar year 2025.

422 Verified Shoppers in 2025

2025 Calendar Year Shopping

Participant Qualifications

Verified shoppers only: All shopped for home services in calendar year 2025

Geographic diversity: Across the United States

Generational diversity: many generations represented (Gen Z through Baby Boomers and older)

Recent experience: Reflects current market conditions

Survey Administration

Administered online with multiple-choice and ranking questions covering research methods, contractor selection, pricing, satisfaction, and demographics.

The Customer Journey

Research Channels: Google Leads Overall

Understanding how homeowners discover and research contractors is essential for effective marketing. The data reveals a multi-channel landscape where digital discovery (Google) edges out relationship-based methods overall, but the picture becomes more nuanced when we examine generational differences.

Key Insight: Google Dominates, But Not Universally

At 39.3%, Google (Search and Maps) is the most common starting point for homeowners overall. However, this masks significant variation by age. Previously used contractors (33.6%) and recommendations from neighbors/friends (25.6%) remain powerful channels, especially for older homeowners.

Social media (11.2%) is more prominent than many realize, with platforms like Facebook and Nextdoor serving as important research channels. Meanwhile, AI search tools like ChatGPT and Perplexity are still nascent at just 3.2% but represent an emerging trend worth monitoring as AI adoption grows among homeowners.

The Full Channel Breakdown

Beyond the top channels, several niche methods play important roles:

Contractor websites (16.7%): Nearly 1 in 6 homeowners go directly to contractor websites, often after finding them through other channels

Maintenance subscriptions (4.2%): A small but meaningful segment discovers contractors through ongoing maintenance programs

Big box stores (1.0%): Home Depot, Costco, and similar retailers account for only 1% overall, though this rises to 3.5% among Millennials and drops to 0% for Baby Boomers, showing stark generational differences in this channel

Notably, the "other" category accounts for minimal responses, suggesting these eight primary channels capture the vast majority of contractor discovery methods.

Generational Divide

Millennials vs. Baby Boomers

Strategic Implications

Millennials | Baby Boomers |

|---|---|

Invest in Google SEO and digital presence | Focus on retention and word-of-mouth |

What Wins: Experience Over Price

The 69% Who Don't Prioritize Price

While price matters, focusing solely on being the cheapest option misses the bigger picture. When homeowners rank their top priorities, only 31% place upfront cost as #1. That means 69% prioritize something else: contractor reputation, system comfort, energy efficiency, or installation quality.

Beyond Price: What the Majority Values

The factors that matter to the 69% who don't prioritize price:

Contractor reputation (19.2%) - Trust and credibility matter. Nearly 1 in 5 homeowners rank this as their top priority, making it the second most important factor overall.

System comfort (10.8%) - Consistent temperature and even airflow. Homeowners recognize that the cheapest system won't matter if their home isn't comfortable.

Energy efficiency (10.2%) - Long-term utility savings. Forward-thinking homeowners consider total cost of ownership, not just upfront price.

Brand/manufacturer (9.3%) - Equipment quality and reliability. Some homeowners have strong brand preferences based on past experiences or research.

Installation quality (4.7%) - Workmanship that lasts. A smaller but important segment recognizes that proper installation is critical to system performance and longevity.

What This Means for Contractors

Competing on price alone means fighting for 31% of the market—often the most price-sensitive, lowest-margin customers. The real opportunity is capturing the 69% who value quality, reputation, and service excellence. These customers are willing to pay for:

A contractor they can trust

Superior system performance and comfort

Long-term energy savings that offset higher upfront costs

Quality equipment from reputable manufacturers

Expert installation that maximizes system lifespan and performance

Responsive communication and professional service throughout the process

Strategic Implication

Rather than racing to the bottom on price, successful contractors should focus on delivering exceptional service experiences that justify premium pricing.

The data shows most homeowners are ready to pay for value if you can demonstrate it through your professionalism, responsiveness, and expertise.

Build your marketing and sales process around the factors that matter to the 69%, not the 31% who care most about price.

How to Create a Winning Experience

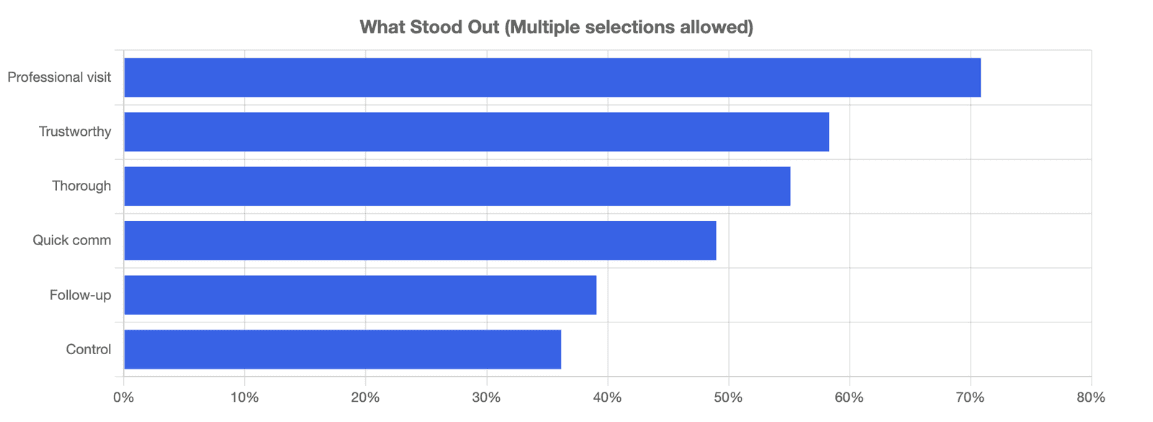

What Stood Out About Winning Contractors

When homeowners chose a contractor, they weren't just picking the cheapest quote. They selected contractors who stood out through exceptional service experiences across multiple dimensions. Understanding what differentiates winning contractors helps identify where to focus your service excellence efforts.

The Experience Excellence Formula

The factors that differentiate winning contractors:

Professional in-home visit (70.9%) - The foundation of trust. More than 7 in 10 homeowners cited this as standing out, making it the single most important touchpoint. The in-home visit is where contractors demonstrate expertise, professionalism, and attention to detail.

Felt trustworthy (58.3%) - Character and credibility shine through. Nearly 6 in 10 homeowners chose contractors who made them feel comfortable and confident. This intangible quality can't be faked but is built through consistency, honesty, and transparent communication.

Thorough in explaining options (55.1%) - Education builds confidence. More than half of homeowners valued contractors who took time to explain different options, trade-offs, and recommendations. This consultative approach helps homeowners make informed decisions.

Quick, responsive communication (49.0%) - Respect for customer's time. Nearly half cited responsiveness as a differentiator. In a market where homeowners contact only 2.1 contractors, being fast to respond can mean the difference between winning and losing.

Prompt follow-up after visit (39.1%) - Staying engaged. More than a third valued contractors who maintained momentum and stayed in touch after the initial visit, demonstrating commitment and professionalism.

Gave me control over decision (36.2%) - Empowering customers. Over a third appreciated contractors who made them feel in charge of the process rather than pressured or rushed into decisions.

Speed and Responsiveness Matter

Nearly half of homeowners (49.0%) cited quick, responsive communication as standing out about their chosen contractor. In a market where homeowners contact only 2.1 contractors on average, being fast to respond can be the difference between winning and losing a job. This isn't just about replying quickly to the initial inquiry—it's about maintaining that responsiveness throughout the entire process.

Similarly, 39.1% valued prompt follow-up after the visit. Contractors who stay engaged and keep the momentum going after the in-home consultation demonstrate professionalism and commitment. This follow-up shows homeowners they're a priority, not just another number in the queue.

Empowering Customers Through Flexibility

Modern homeowners want to feel in control of their decisions, not pressured into quick commitments:

36.2% appreciated contractors who gave them control over the decision process, allowing them to proceed at their own pace

32.9% valued proposals that let them add or remove items before deciding, providing flexibility to match their budget and priorities

21.9% were impressed by interactive proposals with details at their fingertips, giving them the information they needed to make confident decisions

These aren't just "nice-to-haves"—they're competitive differentiators that help contractors stand out in a crowded market. Tools that let homeowners explore options, customize their purchase, and understand exactly what they're getting build confidence and reduce friction in the sales process.

The Human Touch Still Dominates

While technology and tools help (interactive proposals at 21.9%, customizable proposals at 32.9%), the data clearly shows that human factors dominate. The top three differentiators are all about people and relationships:

Professional in-home visit (70.9%)

Felt trustworthy (58.3%

Thorough in explaining options (55.1%)

This reinforces that home services remains a relationship-driven industry where personal touch differentiates winners. Technology should enhance these human interactions, not replace them. The contractors who win are those who combine professional, trustworthy service with modern tools that empower customers.

Putting It All Together

The winning contractors master both sides of the equation: They deliver outstanding human service (professional visits, trustworthiness, thorough explanations, quick communication, prompt follow-up) while also providing modern tools and flexibility (customizable proposals, interactive options, customer control). Neither alone is sufficient—both together create the exceptional service experience that wins business.

Online Pricing in Context

69% look online

15% find id clear

What They Find

15% very clear

46% rough idea

39% not clear

Online pricing provides ballpark at best

Contractor Engagement

Millennial are contacting more contractors in their shopping than previous generations

Overall average | Millennials |

|---|---|

Contact 2.1 contractors | Contact 2.3 contractors |

Winner-Take-Most Dynamic

With homeowners contacting so few contractors, being first contacted is critical. The narrow set means responsive contractors capture outsized opportunities.

Building Credibility

How Homeowners Assess Quality Before Contact

Before reaching out, homeowners evaluate contractor credibility through multiple channels. This pre-contact vetting is crucial—homeowners aren't contacting you unless you've already passed initial credibility tests.

Online reviews (52.5%) | are the most common assessment method. More than half of homeowners check Google, Yelp, Facebook, or other review platforms before contacting a contractor. This makes reputation management absolutely critical—negative reviews can eliminate you from consideration before you even know a customer exists. |

|---|---|

Prior personal experience (37.8%) | is the second most common method. More than a third rely on their own past interactions with contractors, highlighting the immense value of repeat business and customer retention. |

Speaking with friends, family, or neighbors (32.8%) | rounds out the top three. Nearly a third seek personal recommendations, emphasizing the power of word-of-mouth marketing in the home services industry. |

Examples of past work (8.2%) | are checked by a smaller segment, but these homeowners want to see photos, portfolios, or physical evidence of quality before committing. |

Building Multi-Channel Credibility

Successful contractors need to excel across all trust signals

Maintain stellar online reviews - Actively manage your reputation on Google, Yelp, and other platforms. Respond to all reviews, both positive and negative. Make it easy for satisfied customers to leave reviews.

Deliver service worth repeating - 37.8% rely on prior experience; exceptional service creates loyal customers who return and spend more over their lifetime.

Create experiences worth recommending - 32.8% seek recommendations; word-of-mouth starts with remarkable service that customers want to share with people they care about.

Document your work - Maintain a portfolio of past projects, before/after photos, and case studies that demonstrate your quality and expertise.

Understanding Customer Needs Deeply

Contractors who take time to understand customer needs build stronger relationships and win more business. When asked how well contractors understood their needs before presenting options:

58.2% Extremely well: detailed questions & tailored recommendations

30.9% Very well: some questions & relevant options

A remarkable 89.1% of homeowners felt their needs were understood very or extremely well. This consultative approach—asking detailed questions and providing tailored recommendations—is fundamental to building trust and confidence. Only 10.9% felt contractors didn't understand their needs well, suggesting most contractors are doing a good job in this critical area.

Power of Relationships

58.2% Extremely well: detailed questions & tailored recommendations

30.9% Very well: some questions & relevant options

59.2% from Relationships

59.2% selected contractors from prior use or recommendations. The majority of business comes from doing excellent work that earns repeat customers and referrals.

Why This Matters

Repeat business: Positive experiences lead to future calls

Referrals: Happy customers create warm leads

Compounding growth: Each customer becomes a long-term asset

Demographics

Key Insights

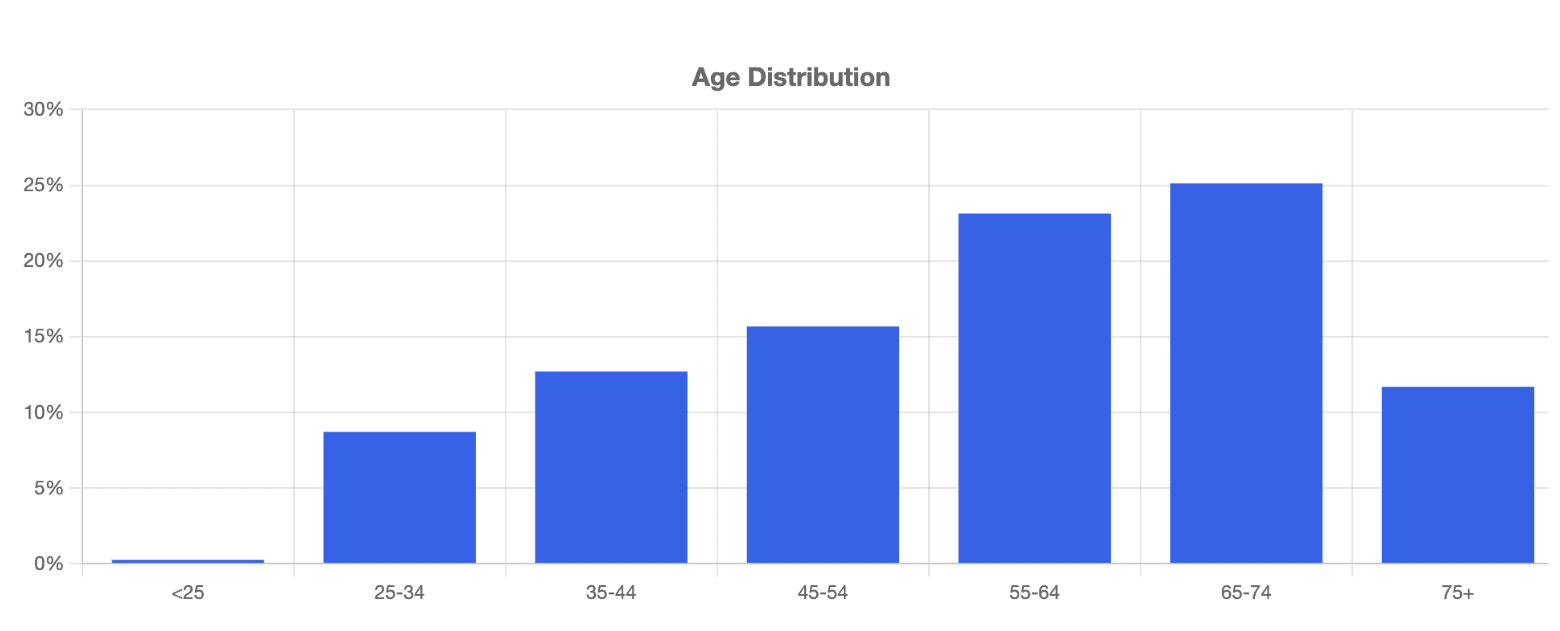

Older dominance: 60% are 55+, with 65-74 the largest segment (25.1%)

Middle-aged: 45-54 accounts for 15.7% (76% are 45+)

Younger underrepresented: Only 21.4% under 45

Common thread: All generations want professional, responsive, trustworthy contractors. The channel differs, but service excellence is universal.

Conclusions & Recommendations

Five Critical Takeaways:

Service Excellence Wins—69% Don't Prioritize Price | Focus on exceptional experiences: quick communication (49%), prompt follow-up (39%), flexible proposals (33%), professional interactions (71%). Win on value, not price. |

|---|---|

Speed and Responsiveness Create Advantage | 49% cited quick communication. With only 2.1 contractors contacted, being fast to respond and staying engaged wins business. |

Empower with Flexibility and Control | 36% valued empowerment, 33% wanted customizable proposals, 22% appreciated interactive tools. Enable customization and transparency. |

Meet Customers Where They Are | Millennials use Google (62%), Boomers prefer previous contractors (36%). Need both: digital discovery AND exceptional service earning referrals. |

Reputation Is Everything | 59% from prior use or referrals. Every satisfied customer multiplies reach. Maintain reviews (52% check), deliver repeatable service (38%), create recommendable experiences (33%). |

Final Thoughts

Most customers aren't looking for cheapest. They want trust, clear communication, control, and professional service. Contractors who thrive master the full service experience, understanding that being responsive, professional, and service-focused wins more than being cheap.

Download this report in PDF format